TRANSFORMATION, CREATIVITY & BEYOND: Part 2

The first speaker, Retail Group Malaysia Managing Director Tan Hai Hsin covered Malaysia’s retail market performances in 2017 and 2018, current retail trends and future prospects of brick-and-mortar retailers in Malaysia.

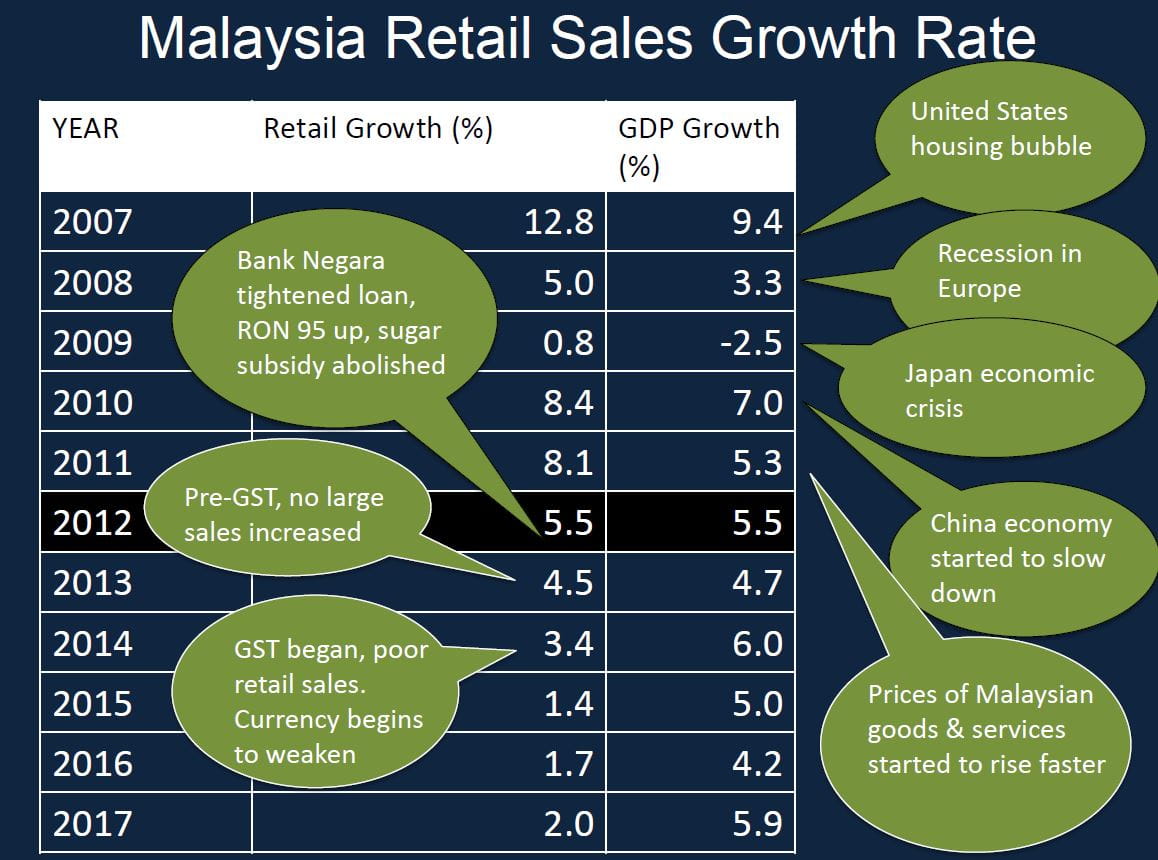

In his Retail Today – An Overview presentation, Tan showed retail growth was ahead of the country’s gross domestic product (GDP) at one time but it has been falling behind since 2012, with the gap widening through the years.

Retail prices increased as the government cut the subsidies. The implementation of the Goods and Services Tax and the weakening Ringgit did not help. Cost of living affected purchasing power, with supermarket and hypermarkets most impacted.

The best performers were other specialty retail stores such as sports, optical and toys. Tan also shared the growth rate in 2017 by the retail sub-sectors.

The closure of foreign specialty stores worldwide like True Fitness, Hello Kitty Café, Pumpkin Patch in 2017-18 caused some panic.

Interestingly in 2017, 71 brands from 17 countries spread over five continents started their first outlet in Malaysia.

He also showed in comparison, the first quarter of 2018 already saw 24 brands from 13 countries across five continents.

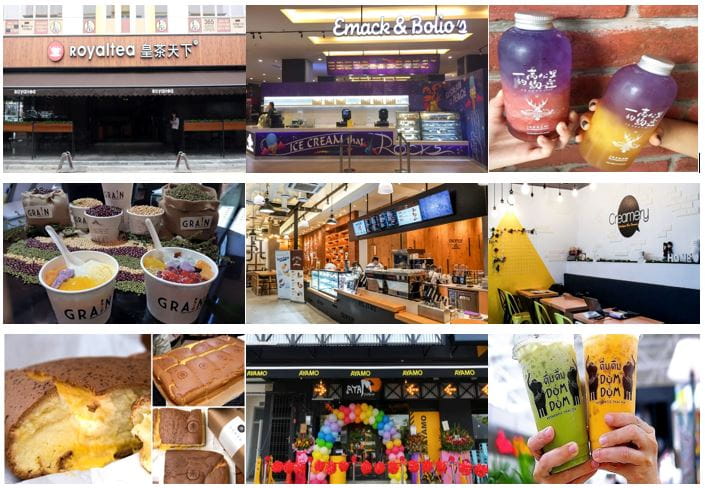

As mind boggling were the number of overseas food & beverage (F&B) companies which have opened and closed, more were located in Johor Bahru than in the Klang Valley.

They included Royal Tea (China), Omaya (Korea), The Alley (Taiwan), Grain Dessert (Taiwan), Creamery Boutique (Thailand), Café Droptop (Korea) and Pre-Tea Q (Taiwan).

F&B accounted for 62% of the foreign retailers in 2017 followed by fashion and fashion accessories at 31%. This trend continued into early 2018.

Klang Valley recorded 71% of foreign retailers with Johor a distant second at 17% in 2017. About 73% of them were located in shopping centres while the rest opened shops.

A 4.7% retail growth rate was projected for 2018 in the face of factors such as continually rising cost of living, increasing food prices, recovery of the Ringgit, the United States (US)-China trade war, growth rate of 5.5% to 6% GDP, increasing consumer confidence level, and the looming election.

Tan confirmed the emergence of popular retail formats like large format fashion retailers, convenience stores, mini markets, pop-up stores, cashless and/or unmanned retail stores.

Questioning where is Private Consumption versus Retail sales, he had a pie chart for household consumption expenditure that showed retail taking up 28% share with Dining Out at 3%.

Breakdown of Household Consumption Expenditure

The dining trend was not necessarily influenced by the taste of food but more importantly by the looks as in nasi lemak related food, crafted cakes and desserts, third wave tea beverages, instagram-shared eating experiences, healthy eateries and high-tech restaurants.

Meanwhile, services accounted for 38% share in the household consumption expenditure. They relate to overseas travel, money changers, pawn shops, fortune tellers, self-service laundrettes, modern barbers, children’s education, cineplexes, talks and seminars, get-rich-quick schemes, ride hailing services and room rentals.

According to Tan, online retailing, accounting for only 2% of the total retail sales, experienced escalated levels resulting from improved logistics as in speedier delivery and major events’ promotions.

The silver lining was news on online retail developments outside of Malaysia showed that physical stores were unlikely to be displaced by e-commerce in the near future.

About 80% of brick-and-mortar retailers and a similar percentage of retail start-ups in the US closed down within 12 months.

He noted, worthy of mention is the success of Amazon, the world’s largest online retailer, and Alibaba the Asia’s largest online retailer.

In recent years, Malaysia has seen both brick-n-mortar and online retailing formats crossing each other and this looked set to continue. Traditional stores have embraced online retailing in several business sectors, with 30% of them being Malaysia Retailers Association and Malaysia Retail Chain Association members.

With 2017 being a tough year for online retailing, online stores in several business sectors have consequently set up brick-and-mortar stores. Examples include Christy Ng, Fashion Valet, Bawal Aidijuma and XiaoMi.

Tan concluded his presentation by assuring that online stores were not replacing physical stores but there is a need to embrace technology advances in the retail industry.

The audience was shown virtual fitting rooms in Japan where one can dispense with changing in and out of clothes, virtual mirror when buying shoes and virtual make-up by Sephora.

DROP US AN ENQUIRY

Let us know if you have any enquiry or question about us. We’ll try our best to help you.