TRANSFORMATION, CREATIVITY & BEYOND: Part 3

Savills Kuala Lumpur Deputy Executive Chairman Allan Soo, the first panel speaker on “A Diverse Perspective”, felt it would be easier to be in the property market than having a restaurant.

Soo also raised the question if we are entering a retail apocalypse, renaissance or revolution.

He mused that it used to be same old thing but now there is innovation, convergence of information technology, payment systems offline, and exciting online systems.

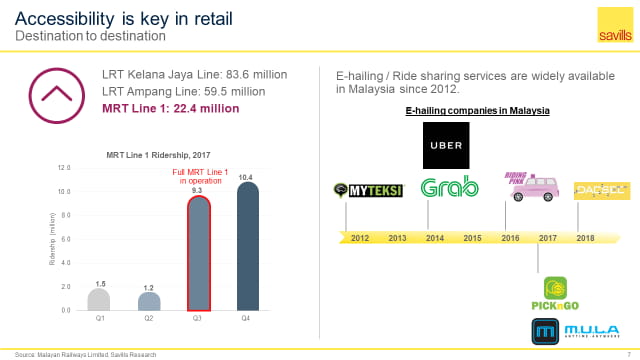

To him, “Accessibility is key in retail,” pointing out that enjoying destination-to-destination conveniences through the light rail transit (LRT) and mass rapid transit (MRT) lines and e-hailing or ride-sharing services have been widely made available in Malaysia since 2012.

He noticed that retailers have been downsizing and rightsizing globally and locally. Ikea, for instance, has plans for mini stores in Southeast Asia to boost their presence, reduce cost and pricing, and create volume with reduced margins.

Starting with Thailand, the Swedish furniture giant will not stock home furnishings in the out-of-city smaller stores, but have the orders delivered from the larger stores in major cities.

Going with “small is beautiful” and serving demand in a different way, it will be a sustainable format if suppliers’ prices can be pressed down without compromise in quality.

Soo said virtually all the big players are rethinking their retail strategies. Going under the radar that big players cannot take, retailers like Village Grocer have been going in the direction of “grab and go” by consumers, very similar to small convenience stores rather than mini markets.

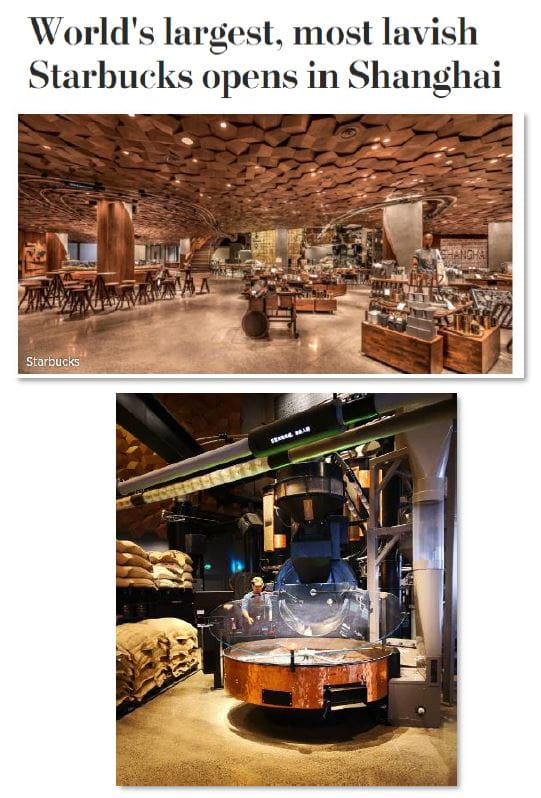

The focus is on specialisation, smaller format, and convenience. Yet conversely, in Shanghai, the world’s largest and most lavish Starbucks opened a 40,000 sq ft space on two floors with coffee roasted on its premises.

Soo found it packed with customers drinking coffee that costs a minimum RMB60 on a Tuesday afternoon. The customers number 2,000 to 3,000 daily, with the place oozing with vibrancy.

He observed that some retailers are going bigger while others are going smaller. Category killers are beginning to lose their appeal with discounters and the larger stores like Walmart and Amazon have taken over from Toys R Us.

However, all is not doom and gloom with bright spots from retailers like Disney Store and Primark in the United Kingdom where brands have been defying the High Street downturn. Zara has even managed to grow!

Soo also shared with the audience the lighter vein of sport shoes being more popular than leather shoes and the popularity of colourful shoes, reminding that successful retailing has to be about knowing customers’ philosophy and culture.

Whilst the rich are getting richer in the luxury retail market, he said at the bottom are the discounters, with compression happening in the middle. With the generational shift, 85% of the luxury growth in 2017 were fuelled by Gen Y & Z.

Soo cited an example of a child who would not eat any beef other than wagyu beef!

Setting aside oversupply or apocalypse and the challenges faced, he said the luxury goods retail market has been doing well, especially in personal luxury goods with the very low and attractive Malaysian tax regime.

The growth in personal luxury goods was also boosted by a revival of purchasing by Chinese customers both at home and abroad. Going forward, the retail market is more exciting and positive, Soo concluded.

During question time, he was asked, “What is the percentage in rental versus sales considered healthy in a landlord’s mind?” Soo believed it should be 3% for supermarkets, 10% for food and beverage, and 7% to 8% for retailers.

To another question, “Do opportunities to develop shopping centres still abound in Malaysia?”, he reminded that we cannot afford to be doing the same old thing in view of the rapid changes that are happening around us. It is crucial to know how and where to build them, identifying the right segment and this comes with experience.

DROP US AN ENQUIRY

Let us know if you have any enquiry or question about us. We’ll try our best to help you.